Weekly Operational Update – North America Classification: Internal

(Florham Park, NJ) … Below are updates to operations for all vessel, terminal and inland services within North

America. This information is subject to change.

Terminal Operations

Due to increased volume, we are experiencing congestion issues at the following terminal locations, New York, Savannah,

Los Angeles/Long Beach and Canada.

U.S. East Coast

New York – 24 to 48-hour vessel berthing delays due to high import dwell. 1-3 inches snow accumulation is expected on

Tuesday January 26th

.

Savannah – 36 to 72-hour vessel berthing delays due to off proforma vessels, increased extra loaders, foggy weather and

holiday closure.

Miami – The import yard is congested due to heavy volumes caused by vessel bunching.

U.S. Gulf Coast

Mobile – Fog is possible through mid-week.

Houston – 72-hour vessel berthing delay due to foggy weather. Channel is open for outbound only. Fog is expected to

clear out the evening of Monday January 25th and remain clear the rest of the week.

U.S. West Coast

Long Beach – Vessel wait time is 10-14 days due to high import dwell and labour shortage.

Los Angeles – Vessel wait time is 14 days due to yard congestion, high import dwell and labour shortage.

Oakland – Vessel wait time is 3-6 days due to labour shortage. SSA OICT will be CLOSED on Friday January 29th second

shift.

Seattle – Vessel wait time is still at 12 -36 hours due to high import volume and cargo diverted from Vancouver.

Canada

Prince Rupert – Vessel wait time is 5-6 days. Yard is at 98% of capacity. Vessel back log is expected to continue as import

volumes continue to be extremely high.

Vancouver – Vessel wait time is 7 days. Yard is at 102% of capacity. Vessel back log is expected to continue as import

volumes continue to be remarkably high.

Vessel Operations

North America East Coast

• COLUMBINE MAERSK V-104, delayed due to carry on delays from her last voyage. Arriving on time in Singapore on

March 3rd.

• MAERSK KALAMATA V-104, delayed due to carry on delays from her last voyage. Arriving on time in Busan on

March 6th.

• MAERSK SERANGOON V-102, delayed due to carry on delays and port congestion in Liverpool. Arriving on time in

Bremerhaven on February 14th.

• MSC ILONA V-101, delayed due to carry on delays and port congestion in Antwerp. Arriving on time in Rotterdam on

February 24th.

• ASTRID SCHULTE V-103, delayed due to carry on delays from her last voyage. Arriving on time in Miami on March

12th.

• C HAMBURG V-104, delayed due to carry on delays from her last voyage. Arriving on time in Valencia on February

15th

.

North America West Coast

• SYNERGY ANTWERP V-103, delayed due to berth congestion in Long Beach. Arriving on time in Barcelona on

March 10th.

• MSC OLIVER V-102, delayed due to carry on delays and berth congestion in Los Angeles. Schedule recovery under

review.

• MAERSK ENSENADA V-102, delayed due to carry on delays from her last voyage and berth congestion in Long

Beach. Schedule recovery under review.

• DEBUSSY V-103, delayed due to carry on delays from her last voyage and port congestions in Australia. Schedule

recovery under review.

• CAP SAN JUAN V-101, delayed due to carry on delays from her last voyage and berth congestion in Long Beach.

Schedule recovery under review.

• MSC DANIT V-102, delayed due to carry on delays from her last voyage and berth congestion in Long Beach.

Schedule recovery under review.

• SEALAND GUAYAQUIL V-104, delayed due to scheduled maintenance in Los Angeles on her last voyage. Arriving

on time in Corinto on February 17th.

.

Inland Rail Transit Advisories

We are also experiencing congestion at all major rail facilities in Chicago, Columbus, and Los Angeles UP and BNSF rail

ramps. We expect delays in picking-up and delivering containers at these locations.

U.S. East Coast

New York Terminals/MMR Rail Delays – We continue to experience ongoing delays for containers moving to/from NYC

terminals and MMR rail facility. This is due to increased incoming volume causing congestion and limited chassis availability.

This delay is affecting units coming from both PNCT and APMT.

Norfolk Southern – New York to Kansas City Rail Delays – Due to ongoing congestion at the NS Kansas City rail ramp,

inbound units destined to Kanas City from New York may experience delays as the New York rail facility is restricted to an

allocation per railing block.

U.S. Mid-West

CSX RV Advisory – Due to ongoing volume surges, reservations (RVs) at the CSX facilities have been difficult to obtain in

some of our most high-volume lanes: (Origin Chicago to destinations Jacksonville, Baltimore, and New York). CSX has

implemented additional measures – increasing train length, increased number of trains per week, and expanding receiving

window for weekend train departures (allowing earlier in-gates on Friday) – to provide solutions to keep the activity fluid

Hamburg Süd stays in close contact with CSX for assistance and ongoing solutions.

Norfolk Southern – Kansas City Temporary Gate Restrictions – In-gates to the Kansas City rail facility are still being metered

but in-gates are not restrictive daily to specific destinations. The daily numbers allowed are increasing but NS is still

encouraging drivers to in-gate as early as possible to guarantee their shipments are accepted.

Cross-Town Trucking Delays (Chicago) – We have been impacted by delays for units moving cross-town in Chicago due

to remap congestion and chassis shortages. These delays have primarily affected our lanes from East Coast terminals to

Omaha and Minneapolis which need a cross-town dray in Chicago. We are evaluating other alternative routing options to

reduce the delays moving forward.

U.S. West Coast

No new issues to report

Canada

CN Rail Facility Congestion – CN has been experiencing ongoing congestion at many of their inland rail facilities and have

placed restrictions for in-gates to control their yard inventory (RV system). As a result, their BIT/Brampton Toronto ERD and

cuts are being monitored closely and receiving windows have been reduced.

Prince Rupert Congestion (CN) – The Prince Rupert terminal continues to experience elevated congestion/rail dwell due

to increased volume at the facility. Terminal capacity is currently 95%. Anticipated dwell is expected average around 3 days

with ongoing rail car support from CN.

Vancouver Centerm Congestion (CN) – The terminal is currently operating at 101% capacity with average dwell remaining

around 5 days, with ongoing high discharge volumes. The CN continues to dray containers to off-dock ramp to help assist.

Equipment Availability

Due to increased volume at terminals and inland rail facilities, there have been ongoing chassis shortages resulting in pick-up delays and

deliveries. Most notably, we are encountering chassis availability issues in the Long Beach/Los Angeles, New York, and Philadelphia

terminals, and the Cleveland, Columbus, Louisville, Nashville, and Atlanta areas.

Equipment availability continues to be an issue at the locations below.

Atlanta – limited 20’ and 40’ available Kansas City – limited 20’ available Omaha – limited 40’ available

Cincinnati – limited 40’ available Memphis – limited 20’ available St. Louis – limited 40’ available

Columbus – limited 20’ and 40’ available Minneapolis – limited 20’ and 40’ available Seattle – limited 40’ reefer availability

Detroit – limited 20’ and 40’ available Nashville – limited 20’ and 40’ available Vancouver – limited 20’ available

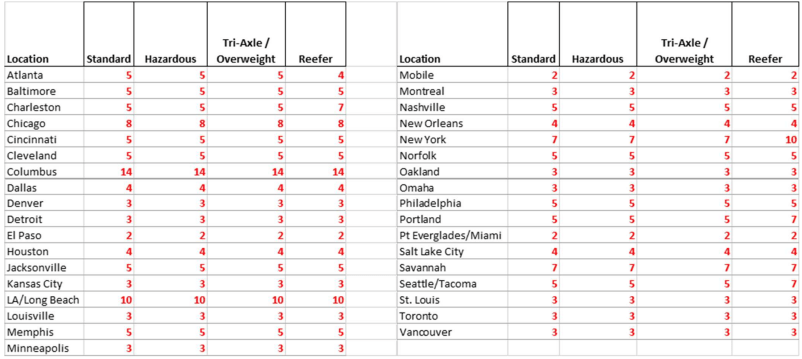

Truck Order Lead Time (days)

Due to the increased volume, we are experiencing reduced trucking capacity in most areas in North America. This will result in delays

pick-up and delivering cargo. Please reference trucking dispatch heat chart to indicate dispatching time for each major area.

Notes

• Truck Order Lead Time (days) = Number of days lead time required to secure truck capacity. 2 days is standard/considered normal.

• Number’s highlighted in RED indicate negative change from the previous week.

• Number’s highlighted in GREEN indicate a positive change from the previous week.

Our quality Hamburg Süd service can be found online at www.hamburgsud-line.com. We offer online booking, shipping instructions, and

quotes as well as track and trace, tariffs and surcharges and schedules. Contact your Hamburg Süd representative with any questions that

you may have.

Thanks,

WCP.